27+ reverse mortgages in spain

Web Think of a reverse mortgage as a conventional mortgage where the roles are switched. It is a special type of home equity loan for senior citizens.

Calameo What Do Experts Say About Global Intergold Is This A Real Opportunity To Earn

Web Con una hipoteca inversa puede eliminar la deuda y ayudar a cubrir los gastos cotidianos.

. Over 100000 loan maximum LTV 70. In order not to make the process take longer than necessary it is advisable to have all the documents required by the bank to. Web In order to qualify for a reverse mortgage all owners and co-owners of the home must be age 62 or older and at least one homeowner must reside in the home as their primary residence at least six months out of the year.

In a conventional mortgage a person takes out a loan in order to buy a home and then repays the lender over time. This mode of reverse mortgage is a complement to Law 392006 known as the Ley de Dependencia Long-Term Care Law. Web The reverse mortgage in Spain is based on a simple idea aimed at helping those over 65 years old who own their own house or flat but find it difficult to make ends meet at the end of the month.

Generally speaking the actual granting of a mortgage in Spain does not usually take more than 2 weeks if everything goes smoothly and you are well organised. The loan does not have to be repaid during the homeowners lifetime. Calculate the fee and expenses with our Mortgage Simulator.

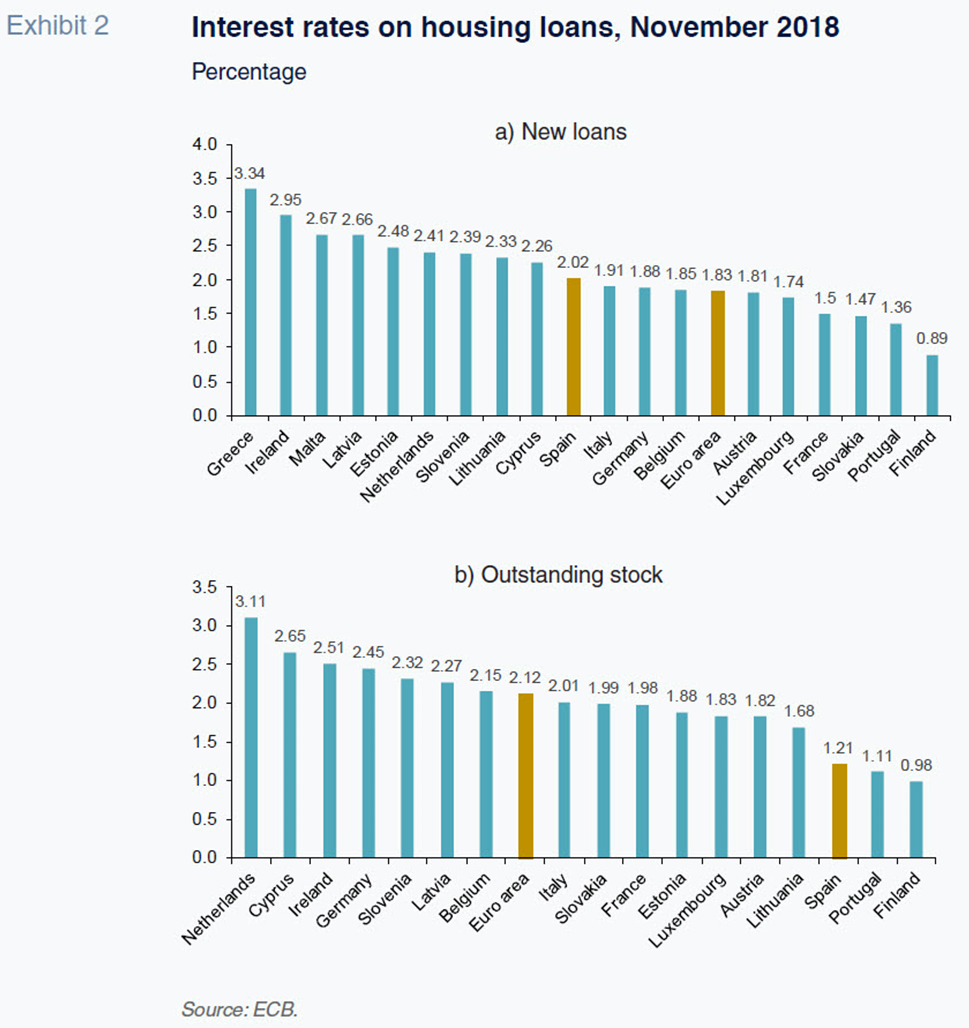

As a general rule most banks will lend on the following criteria. Web In Spain there are three main types of mortgages. Under 100000 loan maximum LTV 60 minimum loan 35000.

Web The reverse mortgage model proposed by the ICO is more restrictive than the generic model regulated by this law as it is a model designed for the disabled or people over 70 years of age who receive a low monthly income. Interest rates are available from 070 pcm and different sectors are considered. Web It works basically as a reverse mortgage.

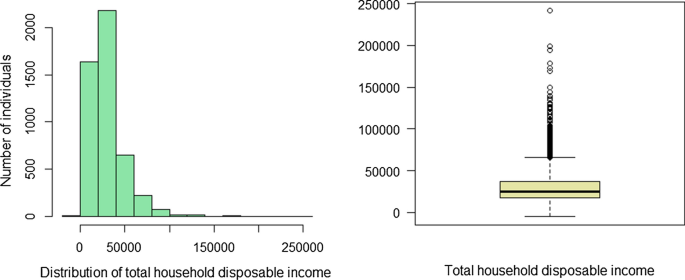

It allows owners to convert some of the equity in their homes to cash by placing a charge against their property which acts as collateral. The Consumer Financial Protection Bureau CFPB recently released a Spanish translation of its Reverse Mortgage Discussion Guide. Web The global Reverse Mortgage Providers market size is projected to reach USD 21606 million by 2026 from USD 15467 million in 2020 at a CAGR of 57 during 2021-2026.

The guide can help older adults understand reverse mortgages the financial programs available to them and how to submit a complaint. Web Mortgages - Banco Santander Get to know Santanders mortgage offer and choose the one that best suits your needs. Calculate the fee and expenses with our Mortgage Simulator.

Web June 28 2019. Web In Barcelona for example housing of 250000 300000 worth euros based on this scenario can be purchased for 60000 70000 euros. Even though the financial products are exactly the same for both residents and non-residents some differences may arise.

Reverse Mortgages Hipoteca Inversa In Spain you can take out a hipoteca inversa also known in English as a reverse mortgage. For very small loans the maximum LTV may be 50. Get to know Santanders mortgage offer and choose the one that best suits your needs.

Variable adjusted with the Euribor fixed and mixed a combination of both. Web How long it takes to get a Spanish mortgage. With a reverse mortgage they can receive payments from the bank monthly over a limited length of time or a one off payment and continue to.

Web Mortgage Direct can help you arrange Bridging Finance throughout Spain for amounts in excess of 500000 for loan terms of up to 36 months and up to 65 LTV. Web For fiscal residents who pay Spanish taxes the maximum mortgage is 80. Web To qualify for a reverse mortgage you must either own your home outright or have roughly 50 equity at least.

Buy-to-let and interest-only mortgages are not available in the Spanish territory. Una hipoteca inversa está diseñada para darle la libertad de usar los fondos del préstamo para las cosas que necesita es su decisión. Web Homeowners can usually decide to receive the equity released from their home either in the form of a regualar income a cash lump sum or as a mixture of both.

It is true that you can hardly move into your new home soon but as an investment in the future of your children or grandchildren this can be a great idea. Bridging finance Some coverage weve received Mortgage Direct in the news. The percentage isnt set by law because exactly how much equity you need to qualify.

What S The Maximum Age For A Mortgage In Spain

Why Does Not The Reverse Mortgage Triumph In Spain News Spainhouses Net

The Reverse Mortgage A Tool For Funding Long Term Care And Increasing Public Housing Supply In Spain Springerlink

Reverse Mortgage In Spain What It Is How It Works Who Can Use It

Why Does Not The Reverse Mortgage Triumph In Spain News Spainhouses Net

The Briefest Lull In My Amp 039 War Against The Black Art Of Psexistrickery Amp 039 And False Hopes Of A Amp 039 New Life Amp 039

Lifetime Loans Or Reverse Mortgages In Spain Explained

Issue 24 25 December 2018 January 2019 By Christina Jagel Issuu

Funcas Spanish And International Economic Financial Outlook Sefo

The Reverse Mortgage A Tool For Funding Long Term Care And Increasing Public Housing Supply In Spain Springerlink

Economic Validity Analysis Of Housing Reverse Mortgages In China The Perspective Of The Financial Decisions Of The Elderly Emerald Insight

Can You Be Too Old To Secure A Mortgage In Spain Right Casa Estates

Reverse Mortgage Professional Lawyers At Mas Vida

Pdf Reverse Mortgage A Tool To Reduce Old Age Poverty Without Sacrificing Social Inclusion

The Reverse Mortgage An Alternative To Supplement Retirement Pensions

Foxes Mortgages Spain Spanish Mortgages For Non Residents And Residents

The Maximum Mortgage Spain Is Generally 60 To Maximum 70